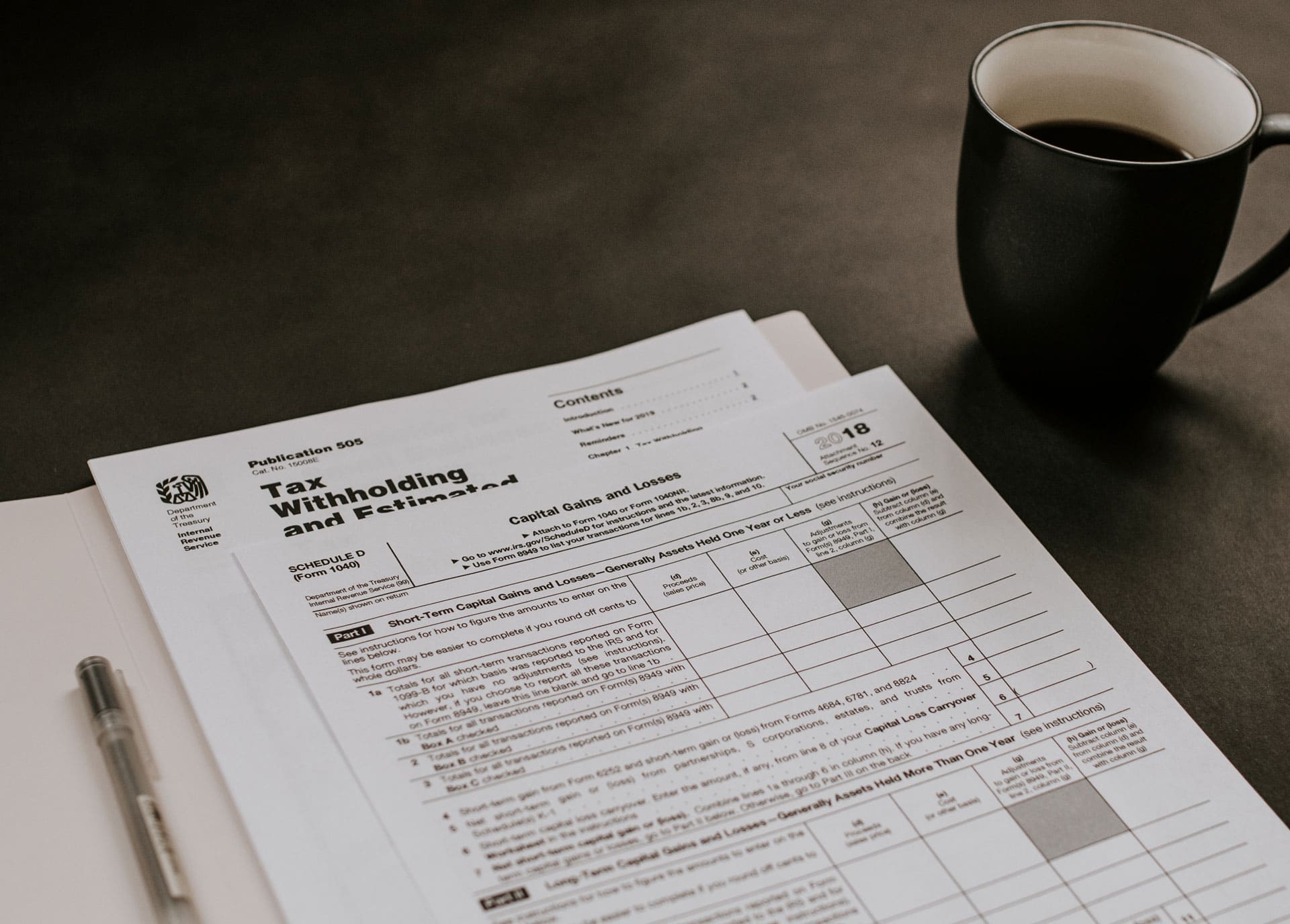

Attention Memphis business owners, you have a deadline coming up! If you have employees, you have to get some forms to the Social Security Administration by January 31. Here’s what you need to know:

According to the Internal Revenue Service, employee wage statements and independent contractor forms are due at the end of the month. Employers need to file Form W-2 (Wage and Tax Statement) and Form W-3 (Transmittal of Wage and Tax Statements) to the Social Security Administration by January 31 to prevent penalties from the IRS.

Employers are also required to file Form 1099-MISC (Miscellaneous Income) with the IRS to report non-employee compensation to independent contractors. Such payments are reported in box 7 of this form.

Why January 31? The answer is actually pretty simple: it gives the IRS time to detect fraud by verifying income reported on tax returns. This requirement was established in 2015 and will continue in the foreseeable future.

“Employers should verify employees’ information,” according to the IRS. “This includes names, addresses, and Social Security or individual taxpayer identification numbers. They should also ensure their company’s account information is current and active with the Social Security Administration before January. If paper Forms W-2 are needed, they should be ordered early.”

The IRS will use this info to detect fraud on individual tax returns. There are no automatic extensions of time to file Forms W-2. The IRS will only grant extensions for very specific reasons. Details can be found on the instructions for Form 8809, Application for Time to File Information Returns.

Depending on how big your company is, turning in these forms after the deadline could amount to some hefty fines. Currently, for the 2019 tax year, documents turned in after January 31 will incur a $50 fee per return or statement (not to exceed $556,500). In a nutshell, you would pay the penalty for every employees’ document not submitted on time. The fees escalate as you get further from the deadline. Learn more about the penalties here.

For more information, read the instructions for Forms W-2 & W-3 and the Information Return Penalties page at IRS.gov. For more stories about running a business in Memphis, check out our Business page.

You might also be interested in: 4 Reasons to Start a Business in Your 30s

![The countdown is ON, Memphis! We’re officially 30 days out from the @unitememphis 5K + 1-Mile Walk/Run—and this year, we’re stepping into unity on 901 Day 🙌🏽

📍 Monday, September 1 | National Civil Rights Museum

🕘 Start time: 9:01AM

🎶 Food, music & fun to follow

Whether you’re walking or running, this isn’t just a race—it’s a movement. And there’s no better time to join in than now. 👟✨

🎓 COLLEGE STUDENTS: Be one of the first 100 to register using your .edu email with promo code NEXTGENUNITE and your ticket is just $10 (that’s a $32 savings 👀). Limit 2 per person, so tell a friend!

Let’s walk. Let’s run.

Let’s #UniteMemphis 💛

🔗 [link in bio]](https://wearememphis.com/wp-content/uploads/sb-instagram-feed-images/526805187_18335272954206022_6056852028660485499_nfull.webp)