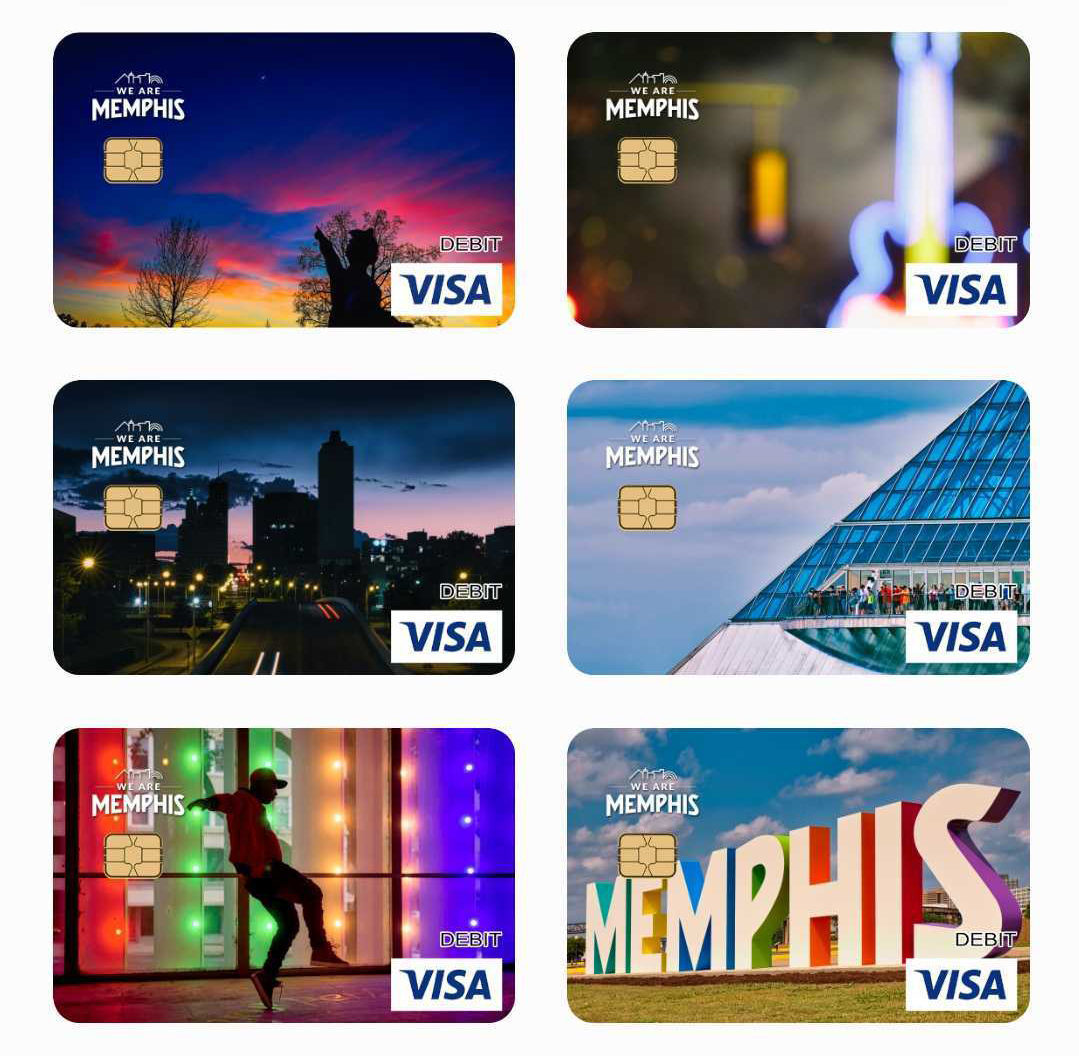

We are excited to announce that we have partnered with CARD, the lifestyle personal finance leader to bring you 16 new debit card designs – straight from Memphis, the epicenter of Soul! Now you can show off your Memphis pride every time you pay at the register.

Choose your favorite Memphis image or mark and get it on a card you can use everywhere Visa debit is accepted. This launch of 16 designs has all the options for We Are Memphis fans. See them all in CARD’s We Are Memphis gallery.

CARD Corporation is a financial technology company offering branded payment cards and full-service online banking features. The company creates financial products that reflect customers’ actual lives, needs and goals. Represent the brands you love and express yourself through personal finance with CARD.

Plus, We Are Memphis cards come with access to CARD’s Premium Bank Account by MetaBank. Here are some of our fan-favorite features:

- Access your paycheck up to 2 days faster with QuickPay Direct Deposit1

- Take advantage of $0 Monthly Fees2

- Never get caught off guard with Optional Overdraft Protection3

- Grow your money over time with the Optional Savings Account4

- FDIC Insured through Metabank

Can’t decide which We Are Memphis image you like best? Don’t worry, you can have up to three cards with different designs attached to your Premium Bank Account!

This awesome partnership was designed to bring We Are Memphis fans closer to their City of Soul and connect CARD customers to the Memphis community. So why wait? Show off your Memphis pride and let’s see how you #BringYourSoul.

- Faster access to funds is based on a comparison of traditional banking policies and deposit of paper checks from employers and government agencies versus deposits made electronically. Direct Deposit and earlier availability of funds are subject to payer’s support of the feature and timing of payer’s funding.

- While this specific feature is available for free, certain other transaction fees and costs, terms, and conditions are associated with the use of this Account. See the Accountholder Agreement for more details.

- The Overdraft Protection (“ODP”) Service is an optional service made available to eligible Customers by MetaBank. Once you enroll and meet eligibility requirements, you will be charged a $15.00 fee for each purchase or transaction settlement greater than $5.00 that occurs while your Account available balance is overdrawn beyond the $10.00 Balance Buffer, up to four (4) Overdraft Protection Services Fees per calendar month. Any negative balance must be repaid within thirty (30) days. Whether we authorize an overdraft is discretionary, and we reserve the right not to pay. For example, we may not pay an overdraft if you fail to meet the eligibility requirements or attempt too many transactions or transactions that create too large of an overdraft. Contact Customer Service or log in to your Account for full terms and conditions that apply, including eligibility requirements and standard overdraft practices. This service may be expensive, so we encourage you to research alternatives before enrolling. Once enrolled, you may opt-out at any time; however, you are responsible to repay any overdrawn amounts on your Account even if you opt-out of the service.

- The Savings Account linked to your CARD Premium Bank Account by MetaBank is established by MetaBank, N.A., Member FDIC. Interest is calculated on the Daily Balance of the Savings Account and is paid quarterly. The interest rate paid on.ate as of 08/17/2020. The minimum balance required to open the Savings Account is $10. The minimum daily balance required to obtain the advertised APY is $10. You must receive one (1) payroll or government benefits direct deposit to be eligible to open a Savings Account. Savings Account funds are withdrawn through the Premium Bank Account and transaction fees could reduce the interest earned on the Savings Account. Funds on deposit are FDIC-insured through MetaBank, N.A., Member FDIC. For purposes of FDIC coverage limit, all funds held on deposit by the accountholder at MetaBank will be aggregated up to the coverage limit, currently $250,000.00.

The Card Premium Bank Account is a checking account established by, and the Premium Visa® Debit card is issued by MetaBank®, N.A., Member FDIC, pursuant to a license from Visa U.S.A. Inc, and can be used everywhere Visa debit cards are accepted.

![The countdown is ON, Memphis! We’re officially 30 days out from the @unitememphis 5K + 1-Mile Walk/Run—and this year, we’re stepping into unity on 901 Day 🙌🏽

📍 Monday, September 1 | National Civil Rights Museum

🕘 Start time: 9:01AM

🎶 Food, music & fun to follow

Whether you’re walking or running, this isn’t just a race—it’s a movement. And there’s no better time to join in than now. 👟✨

🎓 COLLEGE STUDENTS: Be one of the first 100 to register using your .edu email with promo code NEXTGENUNITE and your ticket is just $10 (that’s a $32 savings 👀). Limit 2 per person, so tell a friend!

Let’s walk. Let’s run.

Let’s #UniteMemphis 💛

🔗 [link in bio]](https://wearememphis.com/wp-content/uploads/sb-instagram-feed-images/526805187_18335272954206022_6056852028660485499_nfull.webp)